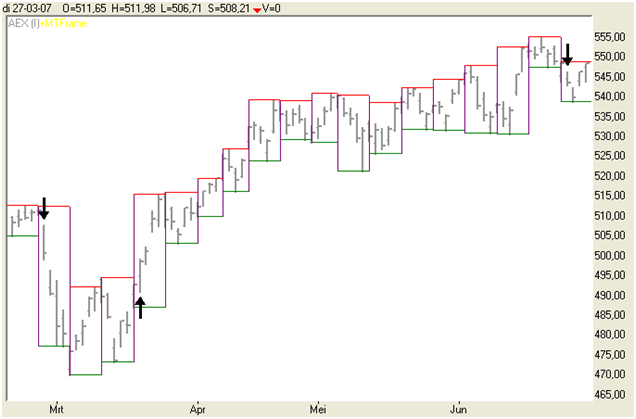

The performance indicator was designed by asset manager Pieter Bos. This system gives an indication of long-term returns. It usually applies weekly prices over as long a period as possible, and acts as a measuring instrument to estimate a certain stock’s risk and return over a given period. The performance indicator displays three lines, each of which represent a percentage. The parameters it uses are period and start date, but it does not provide any specific buy and sell signals.

The first line – centered round the zero line – indicates daily or weekly (for weekly prices) price movements in percentages (current closing price relative to previous closing price).

The second line displays price movements covering the last (selected) period. This line can, for instance, provide price movements for the last year on a daily basis. This not only illustrates the stock’s potential annualized returns, but also reveals the risk of losses – if the line is negative for a protracted period, the probability of poor results was significant.

The third line indicates average returns over the selected period (usually a year – so average annualized return) from the chosen start date. This is the most stable of the three lines and indicates long-term return from a start date selected by the user. The less this line is negative, the better.

Apply here for a free NanoTrader demo.

PARAMETERS

- Period (default one year, I.e.365 days or 52 weeks)

- Start date and starting price - for calculating long-term returns

BUY AND SELL SIGNALS

N/a

DIVERGENCE

N/a

INDICATOR TYPE

Trend-following