Many outbreaks are nothing more than bull or bear traps. Candlestick formations can help reveal these traps and turn losing trades into winners. Bull and bear traps have been

Many outbreaks are nothing more than bull or bear traps. Candlestick formations can help reveal these traps and turn losing trades into winners. Bull and bear traps have been

Just as you need more than a wall to keep a roof up, you need more than a trading idea to generate consistent profits. The combination of flags and candlesticks can produce better

If I had a hammer, I hammer in the morning...

Haramis, Engulfings and Hammer are promising names, but what power do Candlesticks really have? In this article, we will look at one

If you don't have a plan on the stock market, you're playing for luck. I don't know about you, but I don't want to rely on my luck alone, so I need a plan, a strategy.

Try

Do you think that trend lines are too simple to be of much use for actual trading? Find out how, with a little effort and creativity, you can turn a simple idea into a solid strategy

The ATR is a very powerful tool within trading. Starting with the prognostic character up to the concrete component as stoploss within a trading strategy, there are a whole range of

A simply solution for when the markets do not do what they should. Use the broadening triangle - formation. It looks like a megaphone.

More than 100 indicators are available in

"When life gives you lemons, make lemonade". This also applies to the markets. When the market gives you lemons (a normally trustworthy chart formation suddenly stops working), how

And action again! It is not the time unit, but the price movement that is relevant. The factors of time and volume fall by the wayside in this chart as well as in Kagi and Point

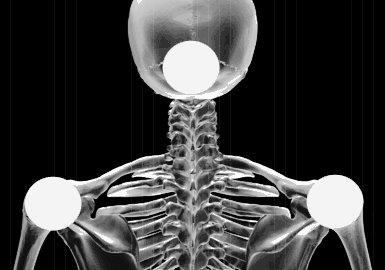

The shoulder-head-shoulder formation (SHS for short) is one of the best known formations of all and can be found in almost every beginner's technical analysis book. We show you the