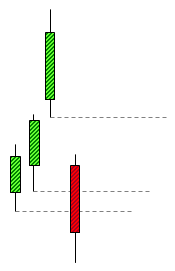

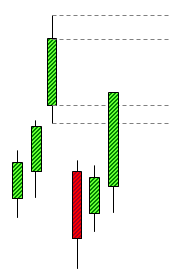

This signal occurs after an intraday gap has been closed. The assumption is that the trend is back on track after the gap closes.

A gap is defined by comparing the open price of the current candle and the low price (high price in the case of a gap up) of one or more previous candles.

This example is showing a Gap down, because the close price of the previous (green) candle is considerably higher than the open price of the current (red) candle.

Now that we have identified the gap, we will need to determine how we define a Gap close.

For example, we can determine that we need the gap to be closed again within the next 5 candles following the Gap candle.

We consider it closed if the close of this candle is equal or above the open of the candle prior to the Gap candle.

In this example we see that the conditions are met because the second candle after the Gap candle has a close price that is higher than the open price of the candle prior to the Gap candle.

A buy signal appears after a gap down has been closed.

A short sell signal appears when a gap up has been closed.