Market structure points are important chart patterns, which every trader should be able to identify and keep an eye on. Two types of market structure (MS) points exist:

- Market Structure High (MSH) points.

- Market Structure Low (MSL) points.

The role of technical analysis is not to predict if the market will go up or down. The role of technical analysis is to detect patterns in the broadest sense of the word. A pattern allows traders to determine if and when they open a position and how they manage the position. Market structure points are one of the most important patterns.

The advantages of market structure points:

- They indicate key reversal moments.

- They are easy to identify.

- They can be used in all time frames.

- They can be used on all instruments.

- They can be used in most trading strategies.

- They are a good tool to learn how to trade.

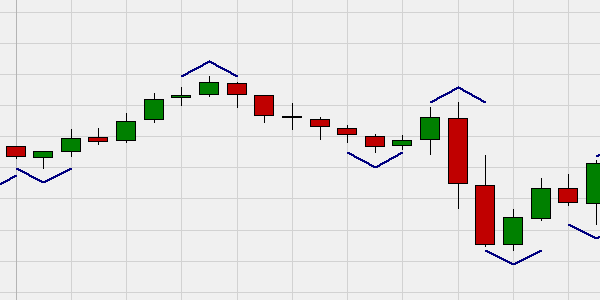

This example shows a random day on the DOW market index on a 60-minute chart. Notice that the day’s main turning points are also MS points. There are always more MS points than key turning points. It is up to trader to try and identify when a MS point and a key turning point coincide.

A MS point consists of at least three candles. Only the highest and the lowest values of the candles are relevant. The colour of the candle is not relevant.

A market structure low (MSL) is a buy signal. A MSL is identified as follows:

- Low candle 1 > low candle 2.

- Low candle 3 > low candle 2.

A market structure high (MSH) is a short sell signal. A MSH is identified as follows:

- High candle 1 < high candle 2.

- High candle 3 < high candle 2.

Although it is possible to trade solely based on MS points, it is not usually done. Trading based on MS points only, tends, mathematically, to a zero result. This is why novice traders use MS points to learn how to trade.*

A long position is bought when a MSL occurs. A short sell position is sold when a MSH occurs. The higher the time frame, the less signals there are, but the better the quality of the signals. This is generally true in trading.

This example shows the DOW market index on a 60-minute chart. There is one key turning point and ... it coincides with a MSL.

Traders using MS points only, follow a very precise set of rules. In short:

- Every signal is traded.

- The stop is always the low (high) of two candles back.

- A position is closed and reversed when the opposite MS point appears.