The Hammer Blast pattern occurs at the end of a down-trend. It often reflects a change in the sentiment of the market. The pattern works well for market indices (DAX, DOW…) and individual stocks.

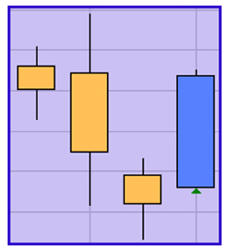

The Hammer candlestick pattern consists of four candles. The two first candles need to be bearish candles. The third candle needs to be a Hammer candle. The fourth candle must be a bullish candle. The open of the fourth candle must be above the close of the Hammer candle.

As soon as the Hammer pattern is confirmed by the termination of the fourth candle along position is bought at the market price. The Hammer pattern does not provide short sell signals.