Orderflow trading has been enormously hyped in the English-speaking trading scene in recent years, while it is less well known in German-speaking countries and is traded by some as an "insider tip" or even as the "only true trading". This does not mean, however, that one can find the proverbial Holy Grail here.

In this article we look at what Orderflow Trading really is about.

Tip

Orderflow trading is only possible with futures. Download a futures trading demo here.

Free e-books for you ...

The Orderflow

If you observe active markets such as the major stock market indices or the most important currency pairs, you will quickly notice that market activity at different times of the day has a different character: the markets are particularly lively in the first one to two hours after the opening of the main stock markets (the European stock markets in the morning, the US stock markets in the afternoon), while in the evening they are as if extinct. In many markets today it is possible to trade virtually 24 hours a day. But a large part of the time the prices move only in a narrow range, so that the short-term oriented Daytrader has to do it with bare noise.

It is better not to trade here, because the probability of price movements cannot be estimated and the risk is therefore too high. The day trader absolutely needs price movements, which he can anticipate and trade with controlled risk. This is where the concept of order flow comes into play.

What moves the price?

Many private traders are not sufficiently aware that price movements on the markets are exclusively caused by the concrete trading activities of market participants: The price rises when and because buying activity outweighs selling activity at a price level. The price falls when the opposite occurs. If the market players do not carry out any trading activities, nothing happens in the market.

The buying and selling activities that unfold over time are called order flow. It is the flow of incoming and executed buy and sell orders. This order flow moves the market. However, it is never constant, but changes its character in phases, depending on the trading activities of the market participants. Sometimes many orders come into the market in a short time, sometimes very few. Sometimes it is a diffuse confusion of buyers and sellers and sometimes one side predominates. Anyone who follows the markets for a while will notice that the order flow and the price changes it triggers are often intermittent and wave-like.

Trade the order flow

These observations represent the starting point for order flow trading. In short, it is important that the trader correctly assesses the character of the order flow and thus the current market situation in order to execute short and fast trades on the basis of his assessment (scalping). The order flow trader, who recognizes that the market is currently flooded with buy orders, wants to ride on this wave and buy immediately. He will hold his position for a short time and close immediately as soon as he notices that the flow of buy orders is drying up and the expected price movement is coming to an end or is not even unfolding as expected. Such trades often last only seconds or a few minutes and only cut short stretches out of the price movement. In return, the experienced order flow trader finds dozens of opportunities to profit every day in lively markets.

Image 1: Order flow of buy orders

Image 1: From around 12:00 o'clock a clear order flow of buy orders was visible, which led to an upward movement in four large pushes (green arrows) as well as in the intermediate phases to the formation of stable price levels (red lines). This order flow finally dried up around 13:45, which led to a reverse price behavior (blue arrow).

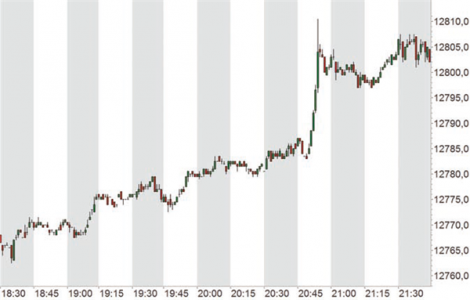

Image 2: Evening order flow

Image 2: In the evening there is usually no strong order flow; the price moves in a very narrow range. For the order flow trader, the movements appear here to be random and not sensibly tradable. Price movements can no longer be anticipated; even the larger movement between 20:45 and 21:00 was not foreseeable.

The profit and loss potential of individual order flow trades will be comparatively low. The order flow trader makes his daily profit from many small single trades. The risk/reward ratio (CRV) will be in the range of 1:1 (stop loss and take profit are about the same distance from entry), i.e. at a level that would be unacceptable for many other trading approaches.

High hit rates

The reason why order flow traders can (survive) with such CRVs and comparatively small profits is that they can or must demonstrate an exceptionally high hit rate: Successful order flow traders achieve a share of profit trades of 75 percent and more. Since this does not react to individual orders but to larger market processes, the probabilities are shifted in favor of the trader: Where there are noticeably strong buying activities, it can be assumed that these will continue for a few seconds or minutes and will not end abruptly in the next second.

Recognizing the order flow

What can be regarded as strikingly strong buying or selling activity naturally depends on the eye of the beholder. This is what makes this approach so special: Orderflow traders have a trained eye that lets them see what is happening. They therefore usually trade naked charts as well, i.e. without indicators and with only a few brands for orientation. The main focus is on the present market dynamics - the here and now of the order flow. In contrast to all other trading approaches, order flow trading does not focus on the question "What do I have to do when?", but on "What is happening in the market; what is the order flow like? Once the trader has recognized this, there is almost no need to ask how to react.

But how does the trader learn to recognize the order flow? It is an ability fed by market experience. The trader must have actively observed a certain market over a longer period of time in order to learn how it usually behaves. It is not enough to just stare at the screen. The trader must also actively deal with the perceived events, think analytically, interpret and learn to interpret for what he observes.

Table 1: Times & Sales

Table 1: Times & Sales (here the DAX future traded on Eurex) is a real-time representation of the orders processed in the market with the exact time of execution, price level, order size and order type (buy orders in blue, sell orders in red). Strikingly large orders are highlighted by the background color, as they indicate larger players in the market and thus a potentially stronger order flow. In the example, it is good to see that an overweight of sell orders moved the FDAX from the price level of 10 056.5 at 10:06:51 to the price level of 10 049.5 at 10:07:05 - a drop of seven points in just 14 seconds.

Orderflow trading as a skill

Successful order flow trading is therefore not based on mere theoretical knowledge, but on a real skill. Two levels should be distinguished here: market competence in the narrower sense on the one hand, and the trader's psychological profile on the other. Market competence refers to the ability of the trader to adequately assess the current market situation, i.e. the character of the order flow. This competence can only be built up through targeted market observation. This is best learned under guidance, which is why order flow trading is predestined to be taught by competent mentors. Suitable for this are longer-term online offers such as trading rooms, Skype groups or professional coaching offers, although it should not be overlooked that many providers in this area are completely dubious.

"The NanoTrader platform is magnificent." – Kai

"NanoTrader is my fourth trading platform and it is by far the BEST platform." – Henry

"I have already familiarized myself a little bit with the platform and I can tell you, that it is the best trading platform I have ever used." – Peter

The psychological side is probably the even bigger hurdle: It is not the assessment of the market situation that is the difficult part, but to trust only one's own market competence without a mechanical trading system or indicators and to continuously enter into trades on this basis. But even those who do not have the nerve to trade "hands-free" in this sense can gain an advantage for themselves through a trained eye for the order flow in other trading approaches. Thus, the recognition of the order flow can also be a good support for the decision on entries and exits in indicator-supported system trades.

Technical Equipment of the Orderflow Trader

Order flow trading requires not only special personal qualifications of the trader, but also that the trader has technical equipment and a stock exchange connection tailored to this trading style. Most orderflow traders work in futures markets, where high liquidity and high-quality market data are guaranteed. Not only the real-time quality of the market data is important, but also a fast and professional trading platform, which prepares the data for the trader in such a way that it can be optimally captured visually. This includes a precise real-time chart (some order flow traders even only use tick charts) and a list of orders executed in the market (Times & Sales; see Table 1). Furthermore, the order flow trader should have as direct an exchange connection as possible so that his own trades can be executed with as little latency as possible. Since in some cases the trader only acts for a few seconds, it is very important to get cheap entries and exits. As everywhere in trading, the order flow trader also competes with other traders and the one who can make and implement decisions faster wins.

Conclusion

Order flow trading is an interesting short-term opportunity to participate in the market flow and generate profits. However, a comprehensive knowledge of the order flow of the market to be traded is absolutely necessary in order to gain a sufficient advantage. If this is too short-term for you, you can also use the order flow as a supplement to your entry and exit criteria on a longer-term basis.

Are you looking for an outstanding futures and CFD-Forex broker?

In the annual Brokerwahl traders voted WH SelfInvest as "Nr. 1 Futures Broker" and "Nr. 2 CFD Broker". For an incredible five times in six years WH SelfInvest is considered the best futures broker, beating all competitors by a wide margin. In CFDs WHSelfInvest came only 0,1 behind this year's first-placed broker. Clients are extremely satisfied with the low commissions, outstanding order execution and the legendary service.

Test WH SelfInvest, download a free demo.