Day trading has become much more popular in recent years. But there is one thing we must not forget: Only a few traders can really make profits with daytrading in the long run. Many beginners venture too early to the top class of trading and act from the gut without much knowledge. Really successful day traders, on the other hand, have clear patterns and strategies to follow. Our cover story shows how some of these daytrading strategies work.

What is daytrading?

Positions are opened and closed on the same day, whereby the whole thing is often repeated several times a day, depending on the trading style. Day traders rely equally on long or short positions, i.e. on rising or falling prices. In the case of short positions, positions are first sold in order to buy back the position later at a lower price. For day traders, short positions are nothing more than inverted long positions. The variety of day trading variants is large. In addition to the most interesting group of intraday position strategies for private traders, there are also scalpers and highly active market makers on the exchanges. Each of the three trading types can be assigned specific trading strategies.

Intraday - positions trading

The goal of position traders is to take positions within the framework of day trading to capture larger movements. This can take some time, which is why the average trading frequency is only one to five trades per day.

While for private traders the cost aspect and perhaps the lack of knowledge about other trading approaches are decisive for which trading style to choose, for institutional market participants it is quite different. Traders, for example, have to consider liquidity aspects with funds (larger positions are often scattered over a whole day in the market), but also follow internal guidelines. Most institutional investors do not want to have short-term gamblers in their ranks, as this type of trading is (erroneously) considered dubious and loss-making. This assessment is supported by the fact that the argument that a good trader must form an opinion in the morning as to where the market could go is stubbornly held, that he must build up a position accordingly and hold it until the evening or even several days. Many superiors in institutions are also of the opinion that a good trader should also be able to "hold out a little". These and similar things have made institutional trading anything but easy - and private traders are even better off because of lower restrictions in some areas.

One trade a day

This strategy is based on trading only ones a day and not necessarily entering the market every day. Daily or hourly charts as well as current events, whose signals are optimized by short-term intraday aspects, often serve as a basis for decision-making. Since the position is sometimes not closed out until the following day, in some cases it is not even a pure intraday position. In addition to the various opening price strategies, this also includes chart pattern approaches, intraday seasonal trades and news-based trading.

Opening strategies

The variants of the opening strategies include opening pullbacks and gaps (price gaps between the opening price and the extreme price of the previous day). The former are based on the assumption that the opening price of a trading day is the most important price because it is based on a high information density. Finally, much of the investor's decision-making process takes place between the close of the market and the opening of the market, as they can use and process a great deal of information during this trading-free period for which they have no time during the day. In this respect, the opening price is of particular importance. At the opening, supply and demand usually form an equilibrium price from which a significant price movement can start.

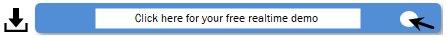

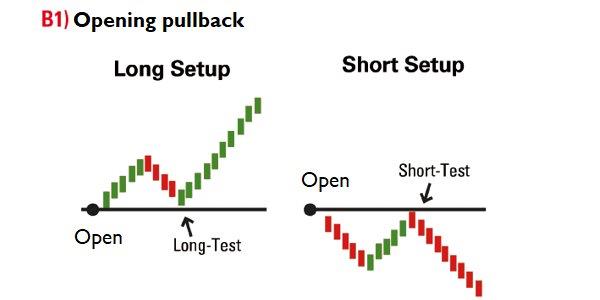

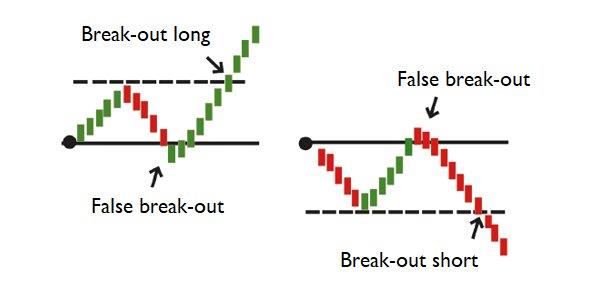

Image 1 (B1) shows the three basic strategies of the opening pullbacks. In the first part you see the pullback approach, where prices move away from the opening price for some time and then test their starting point (i.e. the opening price) again before continuing the trend. The pullback to this point is used as an entry into a corresponding position. If the prices extend the test a little before they move back in the original direction, this is called a false breakout of the opening price (second chart). In this case, a position is not taken again until there is a breakout from the previous range. If the first test fails completely because the prices break through the level of the opening price (also called rebreak; see chart below), the trader waits until the prices start a new test of the opening level.

Above: You can see a pullback approach where prices move away from the opening price for some time and then test their starting point (i.e. the opening price) again before continuing the trend. (Source: www.traders-mag.com)

Above: If the prices extend the test a little before they move in the original direction again, we speak of a false breakout of the opening price. In this case, a position is not taken again until there is a breakout from the previous range. (Source: www.traders-mag.com)

Above: If the first test fails completely because the prices break through the level of the opening price (also called rebreak), the trader waits until the prices start a new test of the opening level. (Source: www.traders-mag.com)

In the case that the gaps are more than closed - i.e. prices return to yesterday's range (trading range) - a trend-following trade can be started later in the event of another movement in the gap direction. The idea here is that the vacuum of the gap from the opening of the day has now been removed and the prices could now build a clean trend in the direction the gap has already indicated. There are often good reasons why prices have opened significantly higher or lower. These reasons could now manifest themselves in the price as the day progresses.

Within a trend, however, gaps can also be a wrong track if they occur against the main trend direction.

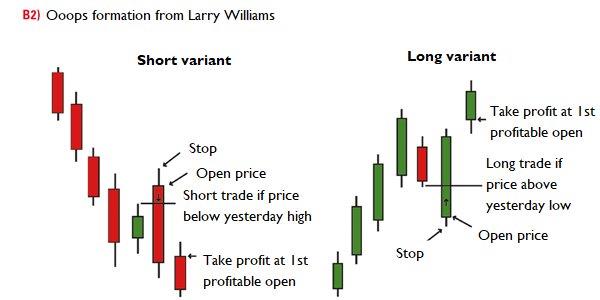

Image 2 (B 2) shows as an example the reverse trading of the opening gap, which became known by the well-known US trader Larry Williams under the name "Oops Formation". This is available as a mirror-image long and short variant. The short variant (left) is an upward opening gap, with prices falling below the previous day's highs again in the course of a trading day and developing further downward momentum. If this formation occurs within an underlying downward movement, it has a higher significance.

According to Larry Williams, the short trade should be opened when prices fall below yesterday's highs. After that, a stop above today's highs will be made. The profit is either taken after the first profitable opening or one lets the profits run and quickly pulls the stop to the entry level and then into the profit zone. The long variant (right) works analogously.

At the top you can see the short version of the Oops pattern, where an opening gap is created upwards and the prices fall below the previous day's highs during the course of a trading day. A short trade is a good choice if prices fall below yesterday's high. The stop is then above today's highs and the profit is either taken after the first profitable opening or you let the profits run and quickly pull the stop to the entry level and then into the profit zone. Below you can see the long variant, which works the other way round.

Trading with chart technique and price patterns

Price formations and patterns provide additional trading strategies for day traders. Most patterns are derived from classic chart analysis. The range of formations extends from simple price comparisons such as the distance from the closing price to the opening price or from the high to the low to conventional chart formations and trend lines to complex combinations of indicator and price patterns. Since defined price patterns provide the trader with a clear set of rules, they help to free the trader from errors of subjective interpretation and to make him less dependent on his own, possibly irrational, behavior. This in turn ultimately leads to better trading processes and thus to an improvement in trading results. In the following, the strategies of intraday position traders, who often trade several times a day, will be discussed. The time horizon can range from a few minutes to several hours. In exceptional cases, positions are held overnight if they are well up and the current situation speaks for it.

Trend following

Trend followers are the long-term investors among the intraday position traders. This form of day trading is particularly suitable for beginners, as the risk is significantly lower than with the other variants. Trend followers always trade only in the direction of a given trend. This means that a position can move quickly into the profit zone if trends persist and also has a lower loss potential than counter-trend positions. In the ideal case, the trend follower is invested relatively early in a trend and can hedge the profits step by step in the course of the movement with the help of trailing hedges, so-called trailing stops. However, if he places these stops too close to what is happening in the market, his position can be unhappily stopped and the trend can continue without him.

The main instruments of trend followers are moving averages (GD) and breakouts. With the former, for example, a buy signal is generated by crossing two different average lines as soon as a short-term GD cuts a longer-term one from bottom to top. Analogously, a cut of the shorter GD with the longer-term one from top to bottom delivers a short signal.

Some traders also use stop-and-reverse (SAR) methods. A position is closed as soon as the crossing of the indicators generates a signal against the previous trend direction, and a position in the direction of the new signal is entered at the same time. Thus, the position (= reverse) is rotated, whereby the entry signal of the indicator is also the exit signal of the previous position.

Trend following strategies in volatile (volatile) sideways phases are problematic. Since the signals are rather delayed, it can happen in a fast-moving market environment that the buy signal does not come until the market has already reached its high and vice versa. Thus, there is a danger that the trend follower will constantly fall into loss positions in a volatile sideways phase. In order to avoid this shortcoming, traders can develop trend following strategies that use the SAR and crossover approaches only as an indication. Trading could then focus on certain market events that occur at the beginning or in the course of a trend and serve as a signal basis.

In the third variant of the intraday trend sequence, breakout trading, the trader places a buy order for a long trade above the highest price of the candle that initiated the breakout. If new highs are reached and the order is executed, the trader places a stop-loss below the low of the breakout movement. The short variant works analogously at the lowest prices. If the position moves into the profit zone, the trend follower pulls the stop to the entry level and then continues to hedge the book profit. In principle, however, the procedure must be adapted to the respective market conditions and time units. For example, in the case of short-term charts - for example on a 5-minute basis - there is a danger that fast but random movements (market noise, also known as noise) will briefly test the intended entry level and then reverse it again. For example, the middle of the respective price range can be used as an alternative entry level on such short time levels.

Against the trend

Counter trend traders are those day traders who try to build up positions at certain price extremes in order to trade possible turning points at an early stage. The counter-trend trader usually trades much more frequently than the trend follower. He buys and sells with a time horizon of minutes to hours. In the optimal case, a counter trend trader manages to sell close to the highs or to go short and to close his short position close to the lows or to go long at this point. This approach works particularly well in sideways markets where prices regularly turn. Some counter-trend traders also use indicators such as the Relative Strength Index or Bollinger Bands to find suitable entry price levels. Problematic and possibly loss-making in this trading technique is the point in time when prices leave a sideways phase and enter a sustained strong trend phase. As strong as the attraction of counter-trend trading is for many day traders, it can be dangerous if stop-loss marks are not consistently adhered to or even position expansions are carried out for loss trades. Here, counter-trend traders must learn to pull the rip cord quickly if the respective scenario does not materialize and a trend develops in the wrong direction.

Swing trading

Swing trading is considered to be the king class of intraday position trading because it combines trend following and counter trend techniques. The aim is to profit from larger price movements - also known as swings - and at the same time from longer trend phases that occur in the course of a day. In order to achieve this goal, swing traders often use the methods of counter-trend traders when entering the market. As soon as a position entered on this basis runs into profit, swing traders tend to use trend following techniques in order to expand positions and secure profits.

The decision making of an intraday swing trader is usually based on chart technical assessments. The trading frequencies and holding periods are manifold and depend on the respective strategy. An example is the ping pong of prices within a resistance and support zone.

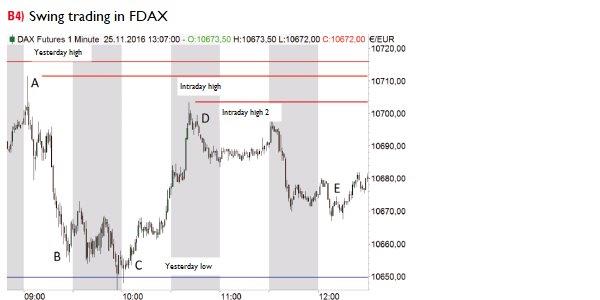

As soon as the prices test the resistance after an upward movement and show the first signs of weakness, the swing trader places a short order and hedges it above the resistance with a stop-loss. He expects prices to run back to support to build strength for a second downtrend. When the scenario occurs, the trader tries to generate a higher profit in the interim trend movement by increasing the position. Then, shortly before reaching support, the trader places an order to exit the short position, as a reversal is possible again. Ideally, he will go long when prices show the first signs of new strength at this level. Depending on whether the higher-level trend is going up or down, it can also only trade the long or short movement or only increase the corresponding direction in the trend course. An example from practice can be seen in image 4 (B4).

Above: The example shows the trading day on 25 November 2016, which began quietly and technically cleanly. Directly after the opening, the market rose to just below the previous day's high and immediately turned down again (point A). Counter-trend traders were able to position themselves here with a tight stop. Following the trend, it was then possible to trade with the idea that the market would run back to the previous day's low. Shortly before reaching it, the trade was profitably closed out and another long trade was opened (point B). This trade would have been stopped out at a loss as the previous day's low had been breached. As the price regained the level at point C, the downward break now appeared to be a false break and swing traders could start another long attempt. With a breakout above 10 665 Euro a trend-following additional position could be opened again. At the level of 10,700 points, the previous daily high was now approaching, so that the long trade could be ended. At point D, the formation of a deeper intraday high became apparent, which was suitable as a stop level for another short trade - again with a trend following component at a breakout below 10 685. At point E, the market then moved sideways in the midday period, so that the trade should be terminated better due to a lack of momentum.

Due to the rather difficult balance between reversal and trend trading, intraday swing trading approaches are more suitable for advanced traders. At the same time, they offer the best opportunities to regularly take an attractive profit from the market. However, it should not be forgotten that, in the worst case, one can be stopped out with both the reversal and trend following positions. As with all intraday strategies, sophisticated risk management is therefore required.

Bottom line

Risk and money management is even more important than the strategy that intraday traders ultimately use. In case of doubt, traders should risk less than too much. In general, intraday trading strategies are only suitable for traders who have extensive experience trading at higher time levels. In addition, successful intraday traders often develop individual variations of certain strategies, which are only described here in general. Experienced day traders can perfect these approaches to the point of intuition, which unconsciously tells them what is the most likely scenario in which situation.

Courtesy of TRADERS´: www.traders-mag.com